Chapter 9 Public Goods

So far, we’ve mostly focused on what are known as private goods. Many goods are private goods - things like cake, apples, movies, pizza, cars, and so on are private goods. However, many goods are not private goods but are critically important for society - things such as clean water, air, and trash removal. In this chapter, we consider how private goods differ from public goods and how the market provides, or more accurately fails to provide, these goods.

9.1 What is a Public Good

The short definition of a public good is any good that is neither rival (non-rival) nor excludable (non-excludable). We’ll consider each of those elements in isolation and then see how they interact to create a public good.

9.1.1 Rivalry

A good is said to be rivalrous if consumption by one party reduces the amount or quality left for others. If I eat the slice of pizza, there is one fewer slice left for you to potentially eat. My consumption has limited your consumption potential. If we are at a small beach and my group spreads out in the shaded area, while you are still able to use the beach losing the shade has reduced the quality of your experience. These goods are said to be rival.

On the other hand, some goods are non-rival. If I turn on my radio and listen to Smart-FM, a radio station out of Cedar Rapids, and you turn on your radio to the same station we would both have equally good experiences. Indeed, if 100,000 people tuned to the same station, our experience would be unchanged. The number of people using a good (in this case the radio spectrum) does not prevent others from enjoying that good or reduce the quality of their enjoyment.

Many goods are not perfectly rival or non-rival. Netflix, for example, is generally equally high quality whether I am the only person watching Tiger King or whether 20,000,000 people are watching Tiger King. We all have the same quality of experience as we would regardless of the number of people watching the show. However, there are limits. Early in the fall 2020 term, due to the large number of people using Zoom to attend classes, the Zoom system was down across the country for a day. During the pandemic, daytime internet speeds have been slower due to the number of people using video chat software during the day for school and work. While normally these goods are non-rival, this is not perfect. In general, goods exist on a continuum of rival to non-rival and we mentally “round” to the most appropriate label.

9.1.2 Excludablity

A good is said to be excludable if there is some way to exclude people from using it without making a payment or otherwise being granted access. Netflix, for example, is excludable: unless you have an account or someone’s password, you will not be able to log into Netflix. However, broadcast TV is not excludable: anyone with an antenna will be able to view over-the-air TV. We creatively call goods like broadcast TV non-excludable as there is no mechanism to prevent people from consuming that good without payment.

9.1.3 Interaction of Excludability and Rivalry

The following table defines the two possible types of goods based on the interaction of rivalry and excludablility.

| Rival | Non-Rival | |

|---|---|---|

| Excludable | Private Goods | Club Goods |

| Non-Excludable | Common-Pool Goods | Public Goods |

9.1.3.1 Private Goods

Private goods are both rival and excludable. Most goods are private goods. Clothing, food, living space, and so on are all private goods because if we are using the good it is not open for others to consume and access to the good is controlled. In order to eat an apple, I must first buy the apple (excludable) and if I eat the apple it is no longer possible for you to eat it (rival). Markets are relatively efficient at delivering private goods.

9.1.3.2 Club Goods

Club goods are goods that are non-rival but are excludable. A good example of a club good is a service like Netflix or HBO Max. In general, outside of extreme cases, the number of people using the service has almost not effect on your ability to use the service (non-rival). However, unless you have a membership (e.g., are part of the club), you are unable to use the service.

9.1.3.3 Common-Pool Goods

Common-pool goods or resources are goods that consumption of is rival but access cannot be prevented. The classic examples are things like publicly owned timber, fisheries, or grazing land. I cannot prevent you from grazing your cattle on the common and when your cattle graze on the common’s grass, there is less grass to eat for my cattle. Goods of this type can experience a market failure called the tragedy of the commons, which we’ll discuss later in this chapter. In public health an important common-pool resource is antibiotic effectiveness. The more that antibiotics are used, the less effective they become. I cannot prevent someone’s use from consuming the antibiotic effectiveness “pool” and their use increases the risk of antibiotic resistance in the future.

9.1.3.4 Public Goods

Public goods are non-rival and non-excludable. I cannot prevent you from enjoying a public good and your enjoyment does not reduce mine. Examples of public goods include things like views of mountains and other impressive natural scenery, clean air, clean water, fireworks displays and national defense. There is no practical way that a given person could be placed outside of the United States’ national security protection (non-excludable) and my personal protection from harm via an invasion is not reduced by your protection. Many issues important to public health - clean air, clean water, waste and sewage removal and treatment, and so forth - are public goods.

Because public goods are non-rival and non-excludable, the free market tends to undersupply these goods.

9.2 Private Markets, Public Goods

Recall from earlier that the total demand curve for a private good (earlier we just called them “goods”) is the horizontal sum of the demand curves for all consumers in the market. For each price, we find the quantity demanded by each consumer and add those numbers to get the quantity demanded by the entire market.

To make this more concrete, suppose our market has two consumers: Charlie and Lucy and their quantity demanded at different prices is given as follows:

| Price | Charlie’s Demand | Lucy’s Demand | Total Demand |

|---|---|---|---|

| 1 | 198 | 74 | 272 |

| 2 | 196 | 74 | 270 |

| 3 | 194 | 73 | 267 |

| 4 | 192 | 72 | 264 |

| 5 | 190 | 71 | 261 |

| 6 | 188 | 70 | 258 |

| 7 | 186 | 70 | 256 |

| 8 | 184 | 69 | 253 |

| 9 | 182 | 68 | 250 |

| 10 | 180 | 68 | 248 |

We sum horizontally because Lucy and Charlie are free to pick different quantities when selecting a private good.

Public goods, however, require that we change how we compute the total demand. Private goods allow us to all select different levels of consumption since they are excludable. You may prefer to buy 5 apples and I may prefer 3 apples and, since they are private goods, we are free to make those different quantity selections. Public goods require us to share a quantity. You may prefer the United States military has 1.3 million soldiers while I might prefer 1.1 million but since national defense (provided by the military) is a public good we must agree upon the size of the military.

Therefore, instead of finding the total number of goods that would be demanded at a given price, we need to find the maximum price all the consumers would be willing to pay for a given quantity. We sum the demand curves vertically to get the total demand for the public good.

Let’s return to our example with Lucy and Charlie as our two consumers. We would look at their respective demand curves and determine the price each would be willing to pay for a given quantity of goods and add these together to find the total price they would be willing to pay. This total price measures the demand for the good if we treat it as a public good. An example set of values is shown below for our two consumers.

| quantity | price_charlie | price_lucy | total_price |

|---|---|---|---|

| 5 | 97.5 | 93.33 | 190.83 |

| 10 | 95.0 | 86.67 | 181.67 |

| 15 | 92.5 | 80.00 | 172.50 |

| 20 | 90.0 | 73.33 | 163.33 |

| 25 | 87.5 | 66.67 | 154.17 |

| 30 | 85.0 | 60.00 | 145.00 |

| 35 | 82.5 | 53.33 | 135.83 |

| 40 | 80.0 | 46.67 | 126.67 |

| 45 | 77.5 | 40.00 | 117.50 |

| 50 | 75.0 | 33.33 | 108.33 |

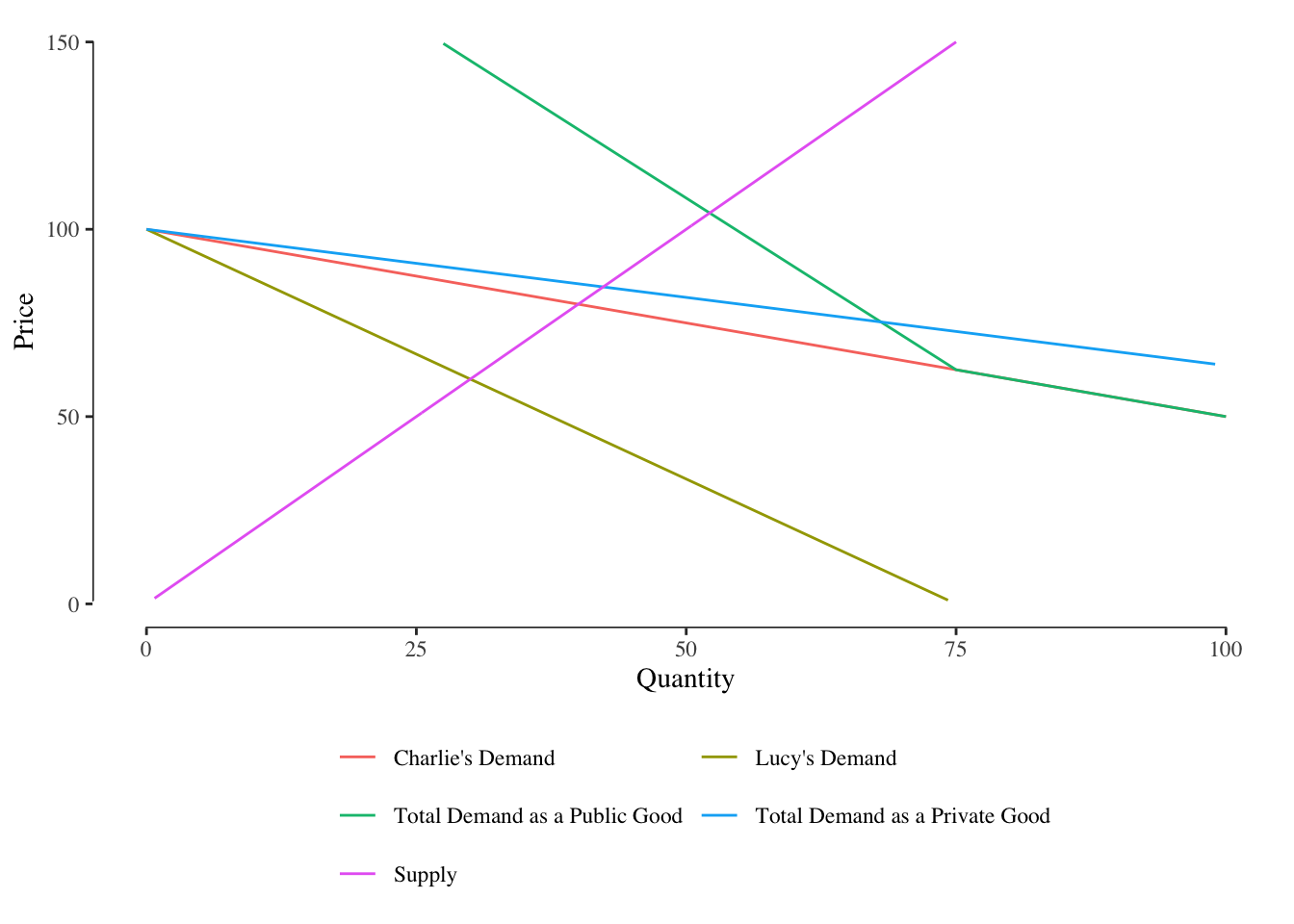

We can put this together graphically as shown in Figure 9.1. There is a lot going on in this figure and so we’ll take it one element at a time. The red line is the demand line for Charlie while the yellow-green line is the demand line for Lucy. If we sum these two lines horizontally, we get the blue line showing us total demand in this market if the consumer’s treat it as a private good. If we sum vertically over these two demand lines, we get the total demand as a public good as shown in the green line. The fuchsia line is the supply curve for this market.

Figure 9.1: Consumer demand curves give us total demand. For private goods, we sum horiztonally (total \(q\) for each \(p\)) while for public goods we sum vertically (total \(p\) for each \(q\)).

This graph also tells us why the private market will tend to undersupply public goods. Let’s suppose our good in question is fireworks. Fireworks are a classic public good: they explode high in the air making it challenging to prevent others from seeing them (non-excludable) and the joy of seeing fireworks does not decrease with the number of others watching the display (non-rival). We can buy and deploy fireworks ourselves in the private market. When we do that we would use our personal demand curves to determine the number of fireworks to buy.

Let’s suppose the demand curves for Charlie and Lucy are given by:

\[ \begin{eqnarray*} P_\text{Charlie} &=& 100 - \frac{Q}{2} \\ P_\text{Lucy} &=& 100 - \frac{Q}{0.75} \end{eqnarray*} \]

Based on these demand lines, we would get the total demand, treating fireworks as a private good, we get the following as our total demand curve. It is defined piecewise because for \(q > 75\), the price Lucy is willing to pay is zero and we need to cover that change in the slope.

\[ P_{Private} = 100 - \frac{q}{2.75} \]

How does this compare to what would happen if we summed the demand lines vertically? Note that this is defined piecewise - if \(q > 75\), the maximum price Lucy is willing to pay is zero.

\[ P_\text{Public Good} = \begin{cases} 200 - \frac{5}{4}q &\mbox{ if } q \leq 75& \\ 100 - \frac{q}{2} &\mbox{ otherwise}& \end{cases} \]

Let’s suppose the supply curve is given by \(2q\). We can then solve for the optimal bundle in a private market:

\[ \begin{eqnarray*} P_\text{Private Good} &=& \text{Supply} \\ 100 - \frac{q}{2.75} &=& 2q \\ 100 &=& 2q + \frac{q}{2.75} \\ 100 &=& (2 + \frac{1}{2.75}) q \\ q &=& 42.3 \end{eqnarray*} \]

Charlie and Lucy will buy a total of 42.3 fireworks for their display.

However, if we treat the good as a public good and solve for the ideal quantity:

\[ \begin{eqnarray*} P_\text{Public Good} &=& \text{Supply} \\ 200 - \frac{5}{4}q &=& 2q \\ 200 &=& (2 + \frac{5}{4})q \\ q = 61.5 \end{eqnarray*} \]

If the fireworks were treated a public good, our two consumers would want to see a total of 61.5 fireworks to maximize their utility. However, since Lucy does not get benefit from Charlie’s utility and Charlie does not get utility from Lucy’s benefit only 42.3 fireworks will occur if left to the private market.

The fundamental problem here is one of free-riding. We discussed free-riding as one of the limitations of the Coase theorem to solve externalities and it appears again here. Charlie’s fireworks provide utility to Lucy and others leading to them underinvesting in the fireworks. The cost of the fireworks is personal but the benefit is common and, as a result, underinvestment happens.

9.3 Methods for Ensuring Correct Supply of Public Goods

As with externalities, identifying the problem (that the free market will under supply public goods) is only the start. We want to consider means of correcting this market failure. Again, we have two major frameworks: private solutions and public solutions.

9.3.1 Private Market Solutions

Obviously, some public goods are provided by private markets. People provide money to charity, to fund research, and so on. There are four major ways in which the private market can overcome the free riding problem and provide a sufficient supply of a public good.

9.3.1.1 Use Fees

A sidewalk cleared of snow after a snowstorm can be a public good. Outside of highly congested areas, the use of the sidewalk is essentially non-rival and there is no way to charge a toll to users of the sidewalk. Removing the snow improves the value of the sidewalk and represents a public good.

In most cities in the United States, snow removal from sidewalks is the responsibility of the person who owns the sidewalk. Some areas, however, have joined together to hire a snow removal service. Suppose a new subdivision wants to ensure the snow is removed from the sidewalks after storms and is concerned about free riding (e.g., failure to remove snow) by the new homeowners. One option for the neighborhood is to hire a snow removal service and then charge fees to all the households in the area to pay for the service. This is typically done through what is called a home owners association (HOA) and all homeowners pay dues to that organization for services such as these.

These programs can work but it is critical that the fee is mandatory and enforceable. If the fee is voluntarily paid, some homeowners may elect to not pay their dues and free ride on the services paid for by the other homeowners. Such a situation is unsustainable.

9.3.1.2 Differences Between People

A second way that public goods can be provided through the private market is differences between people. Returning to the sidewalk and snow removal example, suppose one household really cares about the quality of access and status of the sidewalk. Perhaps they have an elderly relative who needs a more clear sidewalk and therefore spend more time clearing their walk. Alternatively, maybe they have a small lawn tractor snow plow and decide to clear the block. Differences in income (e.g., owning a tractor for snow removal) or differences in preferences (e.g., wanting a clearer sidewalk) can at least partially solve the problem with public goods.

However, this is unlikely to be a full solution. The person who clears the sidewalk for the older relative is unlikely to spend as much time clearing the snow on sidewalks that the relative does not use. Likewise, the person with the tractor likely won’t clear the sidewalk as thoroughly as would be ideal, especially if they do not personally use the sidewalk.

9.3.1.3 Altruism

Humans often engage in altruistic behavior: giving gifts or providing a service without any expectation of recognition or utility. For instance, if I make a contribution to a food bank as an anonymous donor, the food bank is able to provide food to those in need and I get no recognition or direct benefit. We see this in daily life through gifts made to charities, foundations, churches, and directly to others as well as in experimental conditions in psychology. Humans frequently engage in altruism and some of this behavior will provide public goods even in a private market.

9.3.1.4 Warm Glow Giving

Related to altruism, some forms of charitable giving creates a feeling of a “warm glow.” In its most pure form, altruism creates no utility for the person engaging in it. However, some people give gifts and derive utility from the gift. For instance, you could donate money to the University in exchange for having a building, classroom, or center named in your honor. Other times the organization receiving the gift may make public recognition of the gifts (much like NPR or PBS stations announce the names and cities of a few randomly selected donors from time-to-time). Other times, the act of giving creates a sense of satisfaction or the idea of “doing one’s part” to provide a public good. Even without the public recognition, this satisfaction creates utility in exchange for the gift. Because people engage in giving for recognition of internal pleasure, this is one means by which the market may provide some level of public goods greater than would be expected by completely rational, self-interested actors.

9.4 Public Provision of Public Goods

In general, free markets comprised of rational, self-interested actors will not provide the correct level of public goods, even with altruism, warm glow giving, and other mechanisms. As a result, many public goods are provided through public provision - that is government payment.

It is important to note that the simple fact that the government provides a certain good does not make it a public good. The government provides parking spaces in parks which, while non-excludable, are rival. Additionally, the fact that a good is a public good does not restrict it exclusively to public provision. The similarity of the terms “public provision” and “public goods,” combined with the fact that many public goods are government provided, can lead to confusion. Who provides a good has nothing to do with whether it is or is not a public good - only whether it is excludable and rival.

A common mechanism for public provision is levying a tax on people and using the tax receipts to provide the public good. Let’s consider our example from earlier with Lucy, Charlie, and fireworks. The total number of fireworks they shoot off total is 42.3. Lucy fires 11.5 fireworks while Charlie fires 30.8. However, the ideal number of fireworks is 61.5 or just under 20 more rockets.

Let’s suppose each rocket costs $2 and the government decides to levy a tax of $19.20 per person to pay for the extra 19.2 rockets needed. We then have Charlie firing his 30.8 rockets, Lucy firing her 11.5 rockets, and the government providing 19.2 rockets. This gets us to our ideal number of rockets.

9.4.1 Crowd Out

In the example above, the tax did not lead to any behavior changes. However, in general, this would not be true. Charlie was spending $61.60 on rockets before the tax and gets to see his 30.8 rockets and also enjoys the 11.5 rockets sent up by Lucy. We know that Charlie, acting in his own self interest, is willing to pay $61.60 to see 42.3 rockets. With the new tax and new government provision, Charlie might realize he could scale back on his spending on rockets while still enjoying a good number of fireworks.

Charlie could reduce his spending by $19.20 and still see 42.3 fireworks because of the publicly provided fireworks. Even with the tax, this reduces Charlie’s total spending from $61.80 to $52.20. Since he is seeing the same number of fireworks as before, he is equally happy.28

This phenomena where public provision replaces private provision of a public good is known as crowd out. Private parties spend less money providing a public good when there is an influx of public money. This phenomena makes sense. Charlie and Lucy are buying things other than fireworks and so public funding of fireworks would offset some of their spending on fireworks. A charity often is interested in multiple projects at once. The Bill and Melinda Gates Foundation, for instance, does a lot of public health relevant work. One of the major projects focuses on AIDS, tuberculous, and malaria. Let’s imagine the Gates Foundation has devoted $2 billion dollars to each of those diseases and one day the United States announces that NIH will put $1 billion dollars towards research on tuberculous. The Gates Foundation likely will better serve its interests by moving some of its money out of tuberculous research and towards AIDS and malaria in response to the new government money.

We divide crowd out into two types: full crowd out where each dollar of public spending displaces one dollar of private spending and partial crowd out where each dollar of public spending replaces somewhat less than one dollar of private spending. There is significant debate among economists about the extent of crowd out and crowd out is a significant concern whenever the a new public provision of a service is suggested. However, most economists believe that full crowd out is rare and partial crowd out is the norm. Estimates of the extent of crowd out range from 5% to 50% with typical estimates of 20% to 50%. This means that each dollar of public provision of a public good that enters a market drives 20 to 50 cents of private money out of the market. In other words, if a market currently has $100 worth of private provision and $100 of public money enters, the total spending in the market at the new equilibrium will not be $200 but likely somewhere between $150 and $180.

9.4.2 Issues with Providing Public Goods through Public Provision

Levying a tax to raise funds for public provision is only half the story. Once the funds are raised, they need to be spent in such a way as to create the public good. Broadly speaking, governments have two major options.

They can perform the service internally. For instance, most cities provide fire protection (a public good as we cannot exclude someone from a fire departments services and, unless there is a large scale fire or disaster, generally non-rival) as an internal service. The city hires and pays firefighters, provides the trucks and other equipment required, and provides fire stations.

Alternatively, they can contract the service out. Sometimes this is contracting with another city as is the case for University Heights, which pays the City of Iowa City for fire protection services. It could also be contracted out to a third party. Cities generally build and maintain roadways; however, most cities do not have the equipment to build roadways. Instead, they hire private companies to build the road and that company hires labor and brings construction equipment to the project. Typically, projects like this are done through competitive bidding and the city selects the firm that provides the lowest bid for the project.

Of course, the many options exist between the two ends of the spectrum but holding the idea of work either being done internally by the city or contracted out is useful as mental concepts. Generally, cities prefer to contract out services that are either specialized “one-off” events, like building a road, or where savings are possible via contracting out versus having internally (like University Heights contracting out fire protection to Iowa City).

Beyond cost, there are things to consider when determining whether a service is best performed internally or through contracting out. The two most major questions are whether the bidding is truly competitive and fair and whether the interests of the public and the third party are aligned.

The first question, is the bidding actually competitive and fair, is important to ensure that the city is actually getting a good price through the bidding mechanism. If there are only a small number of firms that could do a task, there might not be enough competition to ensure the bids are not inflated. Additionally, there is concern that a member of the government may direct funds towards firms that are favorable to him or provide bribes or kickbacks in exchange for the contract.

The second question, are the interests of the public and private contractor aligned, is equally important. This has been the subject of intense debate as it relates to the operation of prisons in the United States. Historically, most prisons were managed by the United States federal government or the state governments. Recently, private companies have started operating prisons in exchange for payments from the government. The privately run prisons are about 10% less expensive than the state run prisons, largely due to lower wages being paid to the guards. The object of the firm running the prison is to simply lower costs while maintaining a sufficient safety profile or, at least, not being in the news. This is one of the state’s objects as well when running a prison.

However, there are critical conflicts between the interests of the state and the interests of the company running the prison. The state would prefer people serve shorter terms and be released when eligible and safe. The company would prefer to keep the inmate in prison as long as possible to avoid giving up the daily fee. The state is interested in protecting society at large and, ideally, wants the inmate to leave the prison rehabilitated and enter society as a productive person and not return to prison. The private company, on the other hand, makes more money if they come back and do not care if the person leaves the prison improved. This lack of alignment between the interests of society and the companies that run private prisons is a serious concern and should be considered when debating contracting out correctional services.

A similar problem is present when Medicaid services are privatized. The state is interested in the health of the insured individuals, often pregnant women, children, and the elderly, as well as minimizing the total spending. A private firm, however, is chiefly concerned with balancing cost. If a person is denied immediate care and instead presents with a more serious problem, as long as they are no longer on Medicaid, that is a “win” for the company running the plan.

The degree of alignment, or lack thereof, and potential for a failure to have a truly competitive bidding process are the key considerations when determining the extent to which a public good should be privately provided with public financing or publicly provided.

9.5 Determining Preferences for Public Goods

So far we’ve known the demand curves and been able to accurately state the correct level for public goods. However, in practice, we generally do not have that information and need to discover the correct levels and preferences for public goods. This ends up being harder than we may initially expect.

People may be hesitant to tell us how much they value something. If I ask you how much you would be willing to pay for some service that you are currently getting for free, you may be hesitant to answer with a true value if that value is large. You may be concerned that if I knew how much you valued something, I would start charging you for that service. Others may be hesitant to reveal any information to the government as a matter of principle. These difficulties with preference revelation make determining the correct levels of public goods challenging.

Even if you are willing to tell me how much you value some service, you may not know how to accurately price that service. Terry Trueblood Park, south of Iowa City, has a walking and biking path around the lake. It is a lovely park and a great place to walk, bike, or run during the spring and fall. It is a city park and that activity is free. If I were to ask people walking around the lake how much they’d pay for entry to the park, they would probably have a hard time answering. We do not have a historical price for walking around the park and there are no parks in the area that charge admission that we can use as a benchmark. Most people lack knowledge about their preference that are needed to assign a price to the good.

Finally, even if people are willing to answer the question and can accurately price the experience, they may have different answers. I live in an older neighborhood with many tree-lined streets. I can go for a walk around the houses here remaining in the shade during the summer and taking in the fall colors. I may assign a moderate to low value to walking around Terry Trueblood Park. One of my friends lives in newer construction and his street has very few trees. If he wants to walk in the shade or see fall colors, he needs to travel. As a result, he might be willing to pay more to enter Terry Trueblood Park. Another friend lives near Hickory Hill Park and she might not be willing to pay anything to enter Terry Trueblood Park because she can go to Hickory Hill Park instead. We then have three people willing to pay no, moderate, or a high entrance fee to enter the park. The government has to take our preferences and aggregate them into a single value.

The process of preference aggregation is one of the fundamental questions of political economics and the subject of a later chapter.

9.6 Tragedy of the Commons

While not strictly a public good, common-pool resources are a common issue in public health. One of the most notable issues faced with common-pool resources is called the “tragedy of the commons.”

Recall from earlier that a common-pool resource is one that is rival but not excludable. The classic example is the “commons” as an area historically set aside in a town for public grazing. Let’s imagine we own a herd of sheep and need to graze them. If we own the land that they graze on, we would want to match the number of sheep to the marginal cost of restoring the grazed land. If we overgraze the land (graze until the marginal cost of restoring the land is greater than the price we get for the wool), we will lose money.

However, this changes if we do not own the land but instead it is publicly owned. The rancher is no longer paying the marginal cost to restore the grazing land after the sheep move through. Instead, that cost is distributed to all the people using the land. Therefore, the rancher pays less than the marginal cost for grazing and will produce for prices below the marginal cost.

This leads to an unsustainable large number of sheep being grazed on the land, exhausting the land and causing failure.

The most common solution to this problem is by issuing permits. For instance, we issue permits for hunting, fishing, and camping. In western states with large areas of federal lands, we issue grazing permits. This is done to ensure that the common-pool resource of wildlife or grazing land is not over utilized.

This has a particularly relevant application to public health in the form of antibiotic effectiveness. Antibiotics are powerful means of treating bacterial infections and preserving their effectiveness is critical. However, their effectiveness is a common-pool resource. When I take an antibiotic, I use some small amount of the common-pool of antibiotic resistance and there is a small increase in the risk of antibiotic resistance in the future. Each use of an antibiotic pays the average cost, not the marginal cost, with regard to using up the antibiotic effectiveness.

In large scale commercial ranching, animals are commonly held inside for a large portion of the time and many are feed antibiotics routinely. The antibiotics prevent bacterial infections that may result from the close quarters and also may increase the rate of growth. However, each rancher is only paying the average cost of the antibiotic in terms of increased risk of resistance and not the marginal cost. This will create circumstances where the marginal cost of the antibiotic use is greater than the benefit to the rancher but the cost paid by the rancher is less than the benefit. This will tend to result in what society would label an overuse of antibiotics.

Alternatively, both Charlie and Lucy could reduce their spending by some amount such that the total number of fireworks remains 42.3.↩︎